Why PE Funds Are Consolidating Risk Operations

The economics of point solutions no longer work when you're scaling AUM without scaling headcount.

The Scaling Problem Nobody Talks About

Private equity funds have a structural challenge that traditional enterprise risk tools weren't designed to solve: they need visibility across two distinct risk domains—portfolio companies and enterprise suppliers—while operating with lean teams that can't scale linearly with AUM growth.

A fund managing €40B in assets might have 100+ suppliers across legal, admin, technology, and financial services. It might also hold stakes in 50+ portfolio companies, each with their own cyber posture, vendor relationships, and regulatory exposure. The fund's risk and operations teams—often just a handful of people—need to monitor both.

Historically, funds have addressed this by bolting together multiple point solutions: a security ratings platform for external scanning, a GRC or TPRM tool for questionnaire workflows, and plenty of spreadsheet-based reconciliation in between. This worked when portfolios were smaller and the regulatory environment was simpler.

It doesn't work anymore.

The True Cost of Fragmentation

The visible costs are straightforward: enterprise security ratings platforms run $75K–150K annually, TPRM workflow tools add another $75K–150K, and implementation and integration typically cost $25K–50K. But the hidden costs are larger.

| Cost Category | Typical Spend | What You're Actually Paying For |

|---|---|---|

| Security ratings platform | $75K–150K/yr | External scanning—but scores without context or remediation workflows |

| TPRM workflow platform | $75K–150K/yr | Questionnaire distribution—but no validation against external evidence |

| Integration & implementation | $25K–50K | Making two systems talk to each other (partially) |

| Manual reconciliation (1-2 FTE) | $80K–160K/yr | Staff time spent chasing responses, cross-referencing findings, updating spreadsheets |

| Total Year 1 | $255K–510K+ | And it still doesn't give you a unified view |

The operational burden is worse. Point-in-time questionnaires miss emerging risks. Security scores lack business context. And when findings surface in one system, someone has to manually update the other. For funds trying to double AUM without doubling ops headcount, this model breaks.

What's Changed: The Ingest-and-Validate Model

The shift happening now is toward unified platforms that can handle both portfolio company oversight and supplier risk management—not by forcing everyone into new workflows, but by ingesting what already exists.

Consider what a typical portfolio company already has: penetration test reports, SOC 2 attestations, ISO certifications, vendor trust center documentation. Traditional TPRM tools ignore this evidence and send fresh questionnaires, creating "double work" that portfolio teams resist.

Instead of starting from scratch, AI-powered platforms can extract evidence from existing documentation, pre-validate controls, and focus questionnaires only on true gaps. Well-documented companies see response burden reduced by 70% or more.

This changes the conversation with portfolio companies from "please complete this 200-question assessment" to "we've reviewed your existing materials—here are the 15 gaps we need you to address."

What to Look For in a Unified Platform

Not all consolidation is created equal. Some vendors bundle products through acquisition without actually integrating them. Others offer surface-level dashboards over fundamentally disconnected data models. When evaluating unified risk platforms, consider:

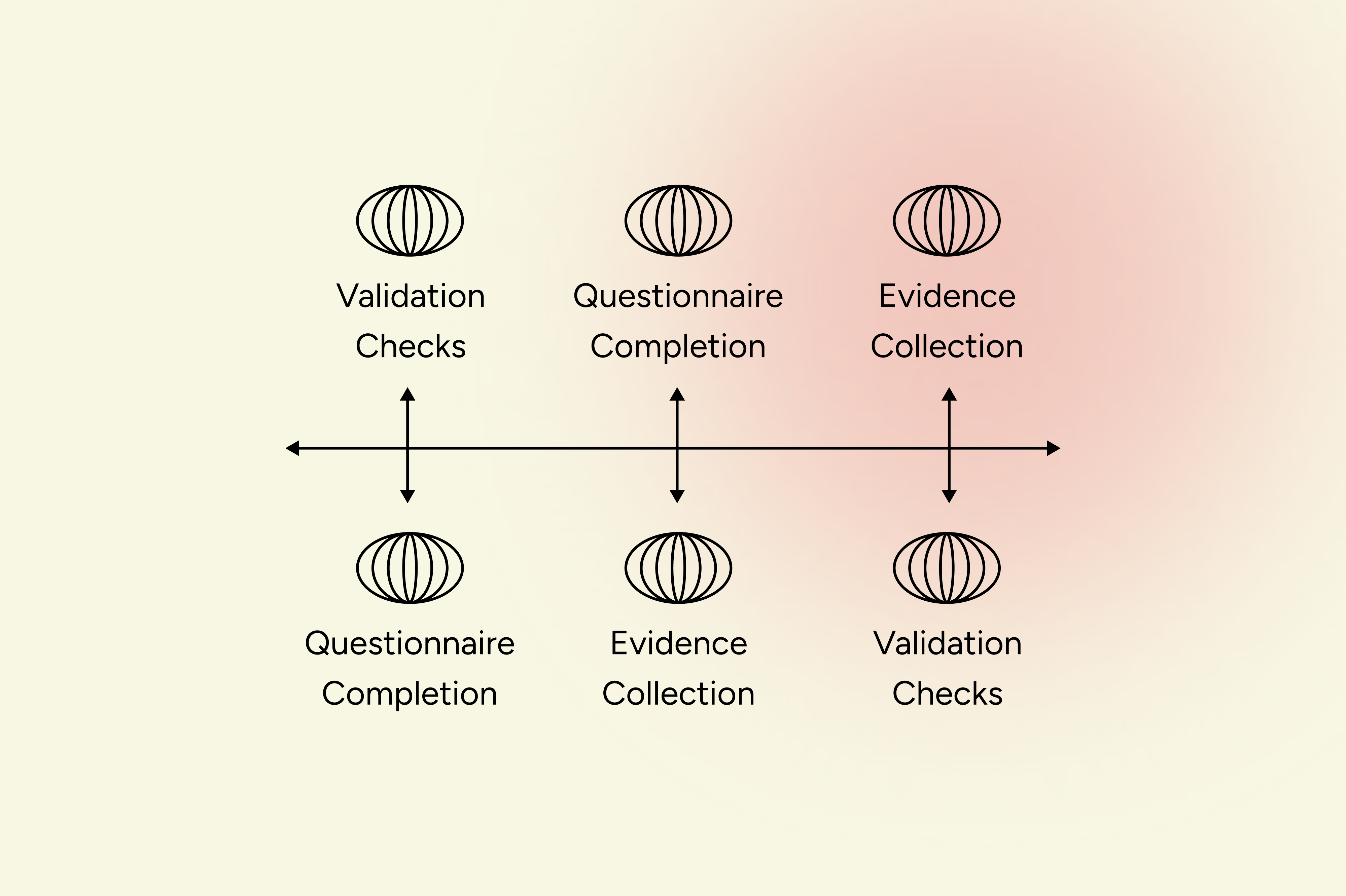

Continuous vs. Point-in-Time

External scanning should run continuously, not quarterly. Attack surfaces change daily. A platform that only refreshes scores periodically will miss emerging exposures.

Evidence Cross-Validation

The platform should compare what entities claim (questionnaire responses, attestations) against what external evidence shows (scanning results, public disclosures). Inconsistencies should surface automatically.

Fourth-Party Intelligence

Your risk doesn't stop at direct vendors. If five of your critical suppliers all depend on the same cloud provider, you have concentration risk that point solutions won't reveal. The platform should map downstream dependencies.

Glass-Box Transparency

Black-box risk scores are hard to act on. When a portfolio company asks "why did we get this rating?", you need to show the evidence and reasoning—not just a number between 1 and 100.

Remediation Workflows

Identifying risk is only half the job. The platform should track remediation, automate follow-ups, and maintain audit trails. Findings without accountability are just noise.

The Results Funds Are Seeing

Funds that have moved to unified platforms are reporting significant operational improvements:

More importantly, these results come without the implementation complexity of traditional enterprise deployments. Because the platform ingests existing evidence rather than forcing new data collection, time-to-value is measured in weeks rather than quarters.

The Bottom Line

Private equity funds are consolidating risk operations not because it's trendy, but because the economics of fragmentation no longer work. When you're trying to scale AUM without proportionally scaling ops headcount, you need platforms that do more with less—not more platforms that each do one thing.

The question isn't whether to consolidate. It's whether to do it proactively, with a platform designed for the problem, or reactively, after the operational burden becomes unsustainable.

See It In Action

We'll assess 3–5 of your portfolio companies or suppliers in under a week—external scanning plus AI-powered diagnostic reports. No questionnaire burden on your teams. See results before you commit to anything.

Contact john@helmguard.ai to schedule a rapid assessment.

.svg)

.png)